On July 9, 2025, a conference dedicated to the presentation of the report «Global Energy Investments in 2025» was held at Peking University. The event was organized by the International Energy Agency, the Peking University Institute of Energy and the China Energy Foundation. The conference was attended by representatives of the Chinese Government, China's largest energy companies, as well as the expert community and banks. Professor Yang Lei, Vice President of the Institute of Energy at Peking University, chaired the meeting. Russia was represented at the conference by Valery Zhikharev, Vice-President of Distributed Power Generation Association.

Cecilia Tam, Director of the Energy Investment Department at the International Energy Agency, and Haneul Kim, Energy Investment Analyst, presented the report «Global Energy Investments in 2025».

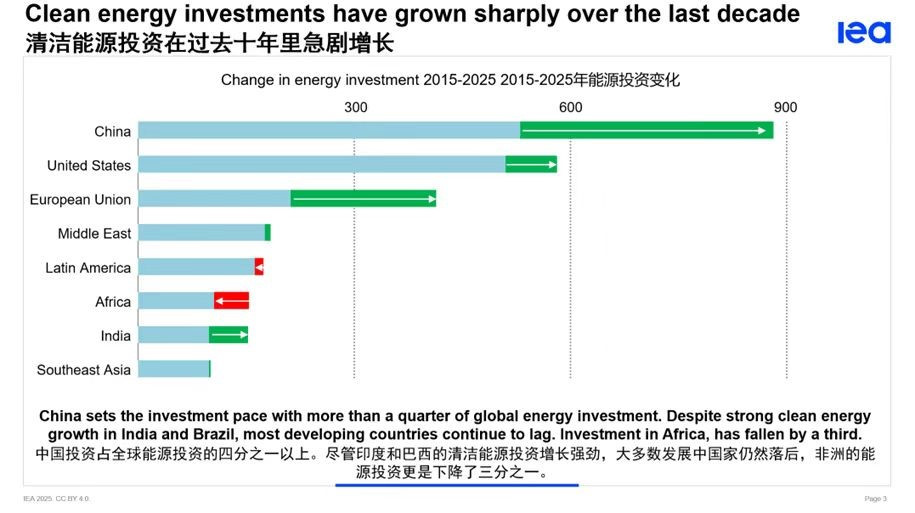

The report noted that since 2015, China, the United States and the EU have become the main drivers of investment in the development of renewable energy. At the same time, China has become a leader with a share of more than 30% in global energy investments, especially in solar and wind. There has been a significant increase in investment in the United States and a one-third reduction in investment in Africa, which, considering the population growth, raises concerns about the availability of electricity.

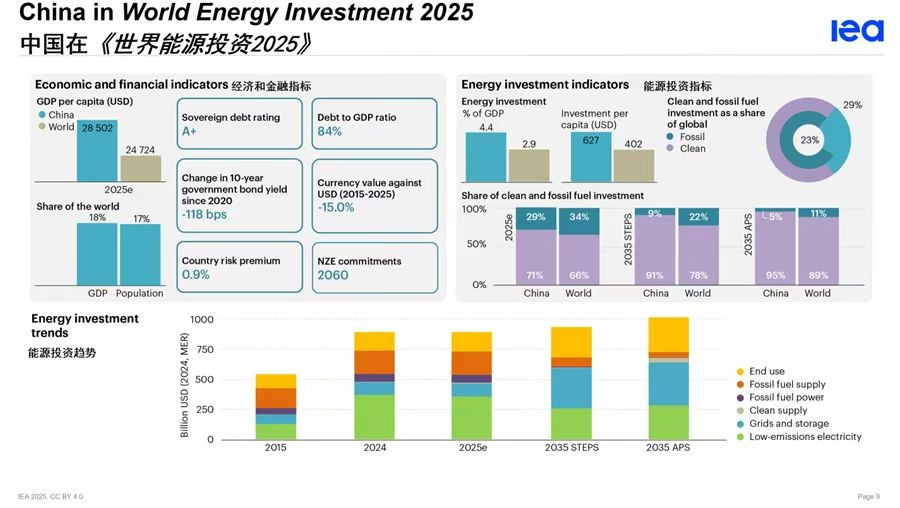

The report paid special attention to China's investment policy. Firstly, this is due to an increase of more than 450 billion US dollars in investments in the energy sector, and secondly, to a bidirectional investment model. By investing huge resources in renewable energy in China, investments in coal-fired power also increased for the first time since 2015.

The report notes an increased diversification of investments in China's energy sector, an acceleration of private capital inflows and a decrease in the share of public financing.

During the report discussion, which was moderated by Wang Feirey, Vice President of the Sinopec Research Institute of Economics and Technology, the participants noted:

- There is a significant differentiation in energy investment policies in developing countries; policies in Indochina and the Middle East are unstable and projects are difficult to implement;

- There is a very high demand for energy investments, requiring changes in fiscal policy that stimulate demand for electricity, infrastructure development, and technological innovation;

- There is a high potential for electricity, management mechanisms and energy storage systems demand in the world.

According to Valery Zhikharev, Vice-President of Distributed Power Generation Association, the cornerstone of global energy investments are energy security issues, limited development of electricity markets in the context of global geopolitical risks and access to electricity.

«Interpreting the results of the discussion on the report from the perspective of national interests, Russia needs to create dialogue mechanisms to remove obstacles to investment from energy consumers, create a healthier investment climate that reduces the role of surrogate investors and promotes direct investment in energy from energy consumers», the expert noted.